The financial institution in brief:

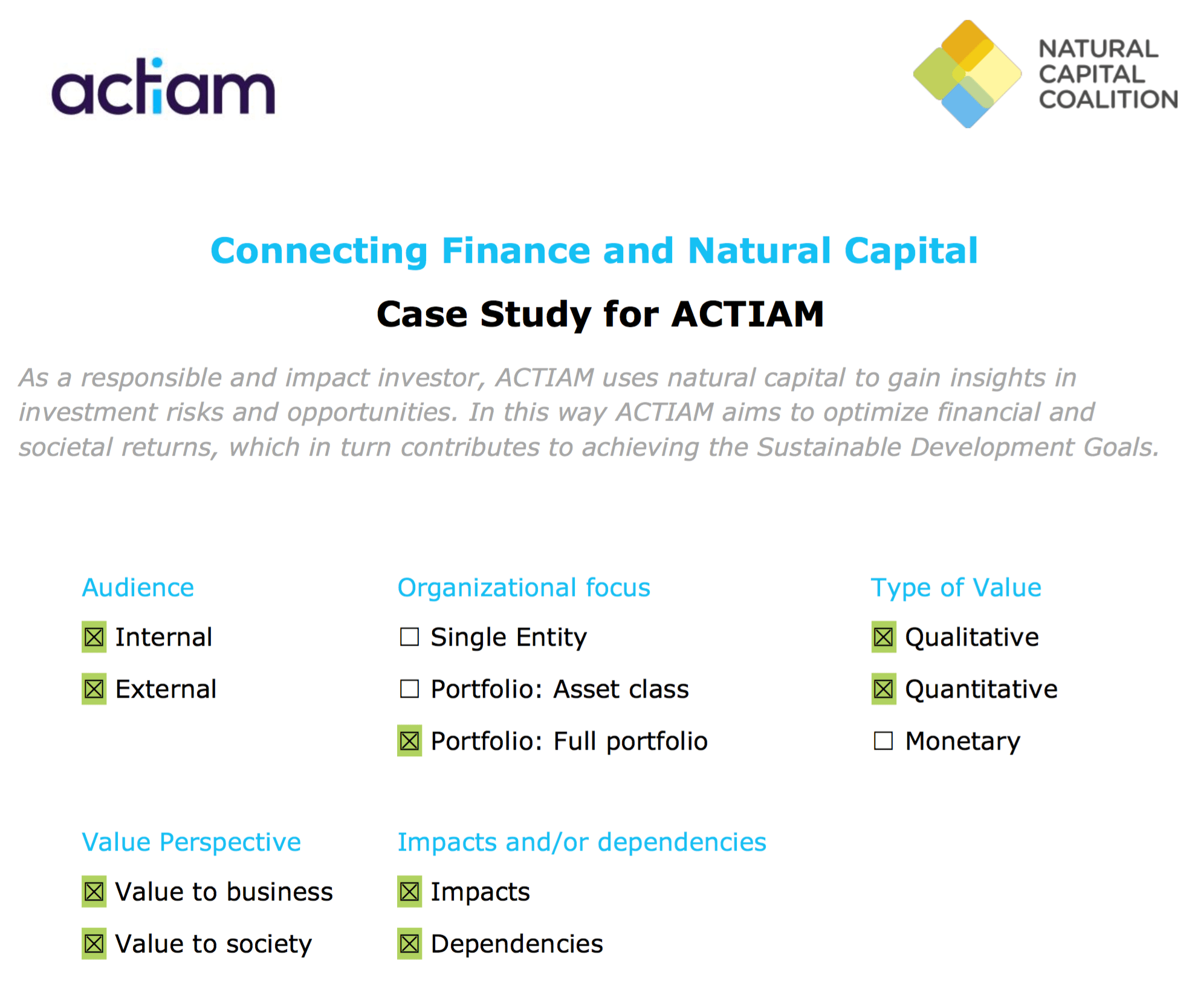

ACTIAM is a responsible and impact investor with EUR 54.1 billion assets under management (December 2017). Our main clients include pension funds, insurance companies, investment funds and banks. Within our investment decisions three focus themes play an important role: climate, water and land. ACTIAM believes that the natural capital risks and opportunities associated with these themes have an effect on the financial performance of companies now and in the future. By gaining insight in this, ACTIAM aims to contribute to tackling the major challenges our world is facing, such as a growing world population and natural resource scarcity, as well as gain insights into how to best manage its own risks and opportunities.

Why use natural capital thinking?

ACTIAM uses natural capital thinking mainly for two reasons. Firstly, ACTIAM uses natural capital to mitigate (hidden) financial risks in investment decisions. For many companies natural capital is a precondition to operate. If they do not manage this in a sustainable manner, this may affect continuity of business operations or increase capital expenses. Secondly, ACTIAM uses natural capital to identify investment opportunities. For example: companies that have integrated natural capital considerations in their business model have the potential to outperform peers in the long term. Ultimately, the aim is to take the most sustainable investment decisions where financial and societal returns are optimized.

What was the approach?

To assess the natural capital risks and opportunities of our investments we have defined measurable targets for each of the three themes that we had identified as material. For climate, we focus on the impact of climate change and have set the target to reduce the greenhouse gas emissions of our portfolios by 40% by 2040 (compared to 2010). For water, we focus on the dependency on water use and have set the target to have a water-neutral portfolio by 2030. For land, we focus on land use and are aiming to set the target for 2030 at a portfolio with zero deforestation. To gain insight in the progress on these targets we collect secondary data from companies and governments. With these data we calculate a carbon footprint (scope 1 & 2) and a water footprint (stressed water consumption in high risk areas and sectors). The outcomes and methodologies are communicated in our (semi-) annual reports and on our website. For the land theme, we are currently exploring ways to quantify the impact of deforestation. The approach here is to look at biodiversity as a control metric, capturing the interaction between the natural capital impacts and dependencies associated with the three focus themes.

What were the outcomes of the assessment?

By assessing the natural capital risks and opportunities associated with our portfolios and comparing them to benchmarks, ACTIAM identifies for example sectors in which specific impacts or dependencies are material. Outcomes are for instance used to set priorities and formulate objectives for engagements with companies.

Next steps

ACTIAM will continue to monitor its progress against the natural capital targets it has set and further optimize these assessments. In addition, ACTIAM will work on forward-looking analyses to identify how potential natural capital risks and opportunities can affect company valuations and how this information can be used for investment decisions taking into account both a financial and societal perspective. Also, we work on standardizing the methodologies for quantifying natural capital impacts and dependencies in the financial sector. As part of the Platform Carbon Accounting Financials we have, in partnership with financial institutions, set the first steps by publishing a report on a methodology for carbon accounting. Membership of a similar platform on Biodiversity Accounting, enables ACTIAM to promote further natural capital thinking at a sector level.