The financial institution in brief:

eftec is the leading environmental economics consultancy in the UK, supporting investment and management decisions with sound economics since 1992. We have worked on over 500 projects with corporate, public policy and non- governmental clients. We provide a bridge between the academic research and applied work and are considered pioneers in economic valuation and natural capital accounting, in particular, through the development of the Corporate Natural Capital Accounting framework (the natural capital balance sheet) for the Natural Capital Committee in the UK.

Why use natural capital thinking?

We have been applying natural capital principles and accounting to corporate and public sector decision-making for several years to help our clients understand their natural capital impacts and dependencies; and whether they are prepared for future risks and opportunities.

Natural capital thinking helps investors get more out of the current ESG assessments, converting their output-based metrics (e.g. tonnes of emissions) to outcome-based metrics (e.g. health impacts). Unlike standard ESG analysis, outcome-based natural capital metrics also cover a wider set of environmental impacts and dependencies and can be forward-looking. Furthermore, assessments of natural capital impacts and dependencies are closely linked to impacts and dependencies on social capital – an often underinformed part of the ESG universe.

What was the approach?

We developed the Natural Capital Statements approach to integrate the natural capital balance sheet (as the Corporate Natural Capital Accounting framework) and the income statement (aka the EP&L, pioneered by Kering). We tested the extent to which these statements could be prepared using only publicly available financial and ESG data (including CDP reporting) at an organisational level. To our understanding, this is the first simultaneous application of the natural capital income statement and the natural capital balance sheet.

The data we used came from the sustainability reporting by SCA (a paper and pulp company), specifically for their forest business, based in Sweden. This was completed as an independent assessment without the involvement of the company.

What were the outcomes of the assessment?

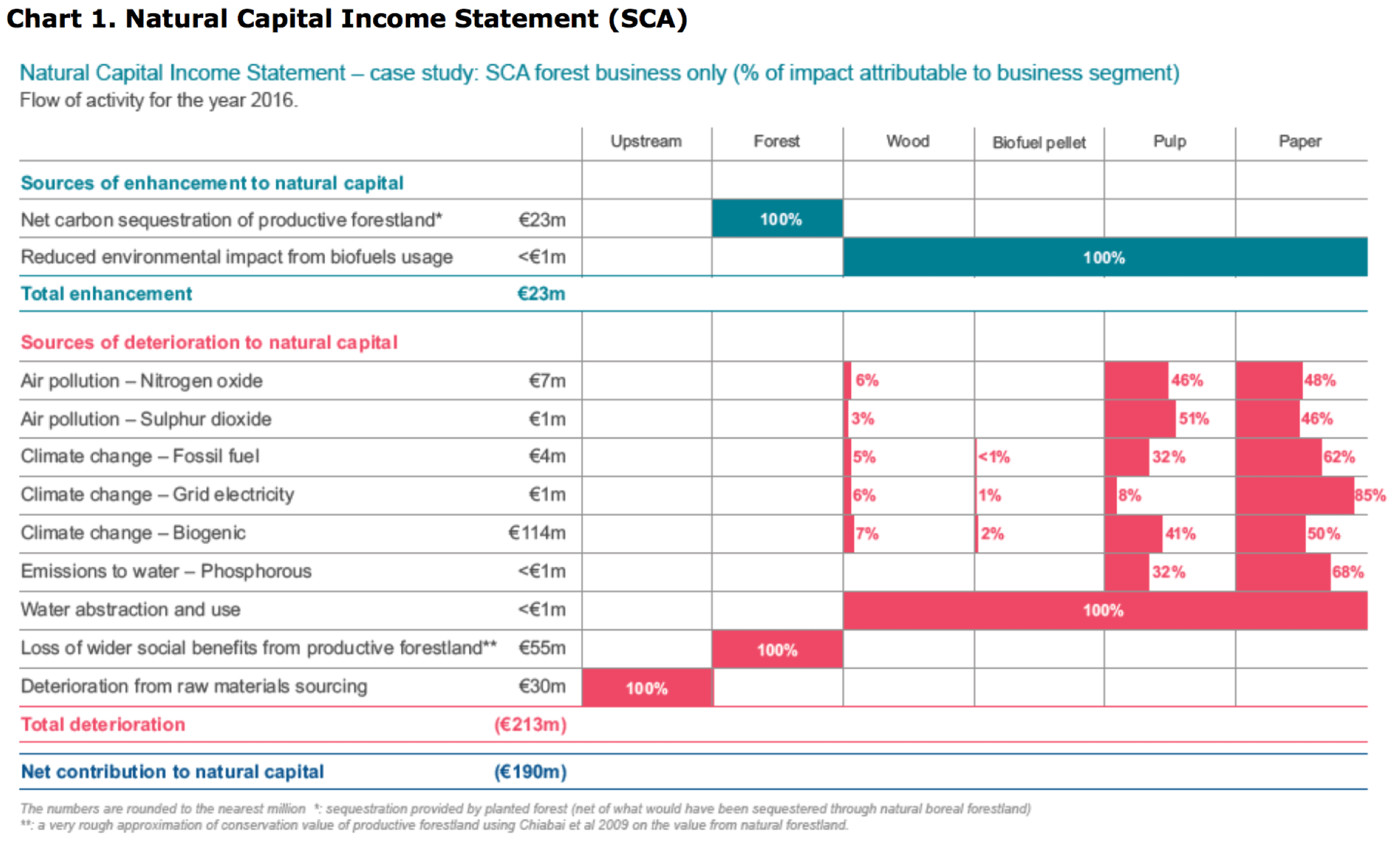

Natural Capital Income Statement shows that, overall, SCA makes a negative net contribution to natural capital (i.e. to society) in 2016 due to its impacts along its supply chain (Chart 1).

Although the net contribution to natural capital is negative, for a complete picture of the company’s sustainability it should be read in conjunction with the financial reporting statements and natural capital balance sheet. Comparison of all these statements will be useful for investors in distinguishing the best in class performers. Such new analysis is necessary when, as in the case of SCA, most companies achieve other markers such as close to 100% sustainable certification of wood.

The income statement can also show:

- The relative contribution of each business segment to both enhancements and deteriorations of natural capital. This helps identify hotspots in the supply chain. For SCA, a particular hotspot is the paper and pulp segments. For investors, this is valuable information, as this business segment is set to double production in 2018 with the re- opening of the Ostrand mill.

- There are positive impacts from carbon sequestration when looking at the growth of the plantation forestland compared to what would have been slower growing boreal forestland.

- Biofuels also have a marginally positive impact – SCA uses biological matter gathered during its operations and thereby avoids using the mix of fossil fuels (and its associated emissions) in the rest of the supply chain.

- It is not possible to distinguish between business segments on the positive impacts of biofuels and the negative impacts of water abstraction, as this information was not available.

- Raw material sourced externally (including energy use from the raw material production) has a significant estimated negative impact. This was based on modelled sector-level data.

- Plantation forest has lower biodiversity and habitat value compared to the baseline of natural boreal forest. This is shown as a deterioration in value to society and is labelled ‘wider social benefits’.

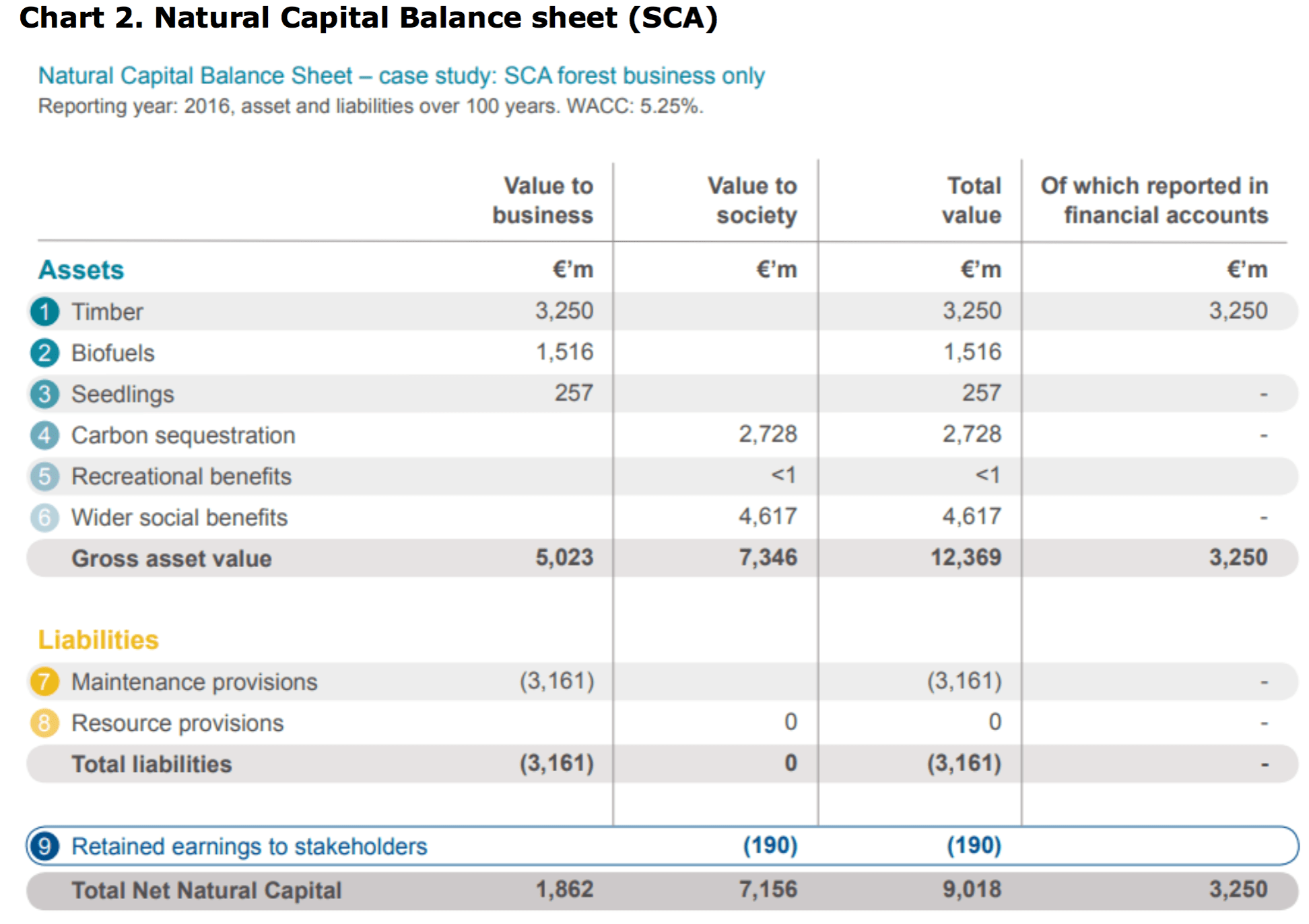

Natural Capital Balance Sheet shows that the natural capital assets SCA impacts and relies on to provide value to both the business and society. Only a third of this value is accounted for in the financial accounts.

The balance sheet values the assets and liabilities over a 100-year time horizon to reflect SCA’s forest management schedule and uses SCA’s internal Weighted Average Cost of Capital (WACC). Both these parameters could be amended to reflect an investor’s holding period and required rate of return (if necessary). This assessment of SCA’s dependence on its natural capital (Chart 2) indicates:

- The only figure that is (explicitly) included in the financial accounts is the asset value of the standing timber (following IAS 41). The value of biofuels and seedlings touch on the financial income statement but are not capitalized.

- The value of biofuels is estimated as the avoided energy costs, which hedges SCA’s exposure to rising fuel costs. This production is set to increase based on management’s targets.

- Similarly, the value of seedlings is estimated as the avoided cost of purchasing seedlings. Although, of concern, the trend in reporting on seedlings over the last five years indicates that production may be stagnating.

- The fair valuation of the forestland extends beyond the value to the business and includes values to society, for example, from carbon sequestration. This also feeds into the wider value/brand image of a company like SCA with a sustainability-focus.

- The interlink between the timber value and carbon sequestration would not have been picked up in standard sustainability reporting. SCA’s forest management schedule is set to enter a more intensive phase in 2031, which would also mean slower carbon sequestration. Reporting timber growth and sequestration together makes this trade off more explicit. External factors like the discussions at European-level on accounting of forest sequestration [link]; the risk of possible changes to regulations; or the possibility of legal action by NGOs on SCA’s forest management practices make such reporting even more important.

- The wider social benefits estimate the conservation benefits from the plantation land and land set aside for conservation. It provides a starting point for investors to engage with management and to respond to concerns from NGOs, beyond qualitative examples and hectares of land recorded in sustainability reporting.

- The maintenance costs account for estimated projected operational expenditure on the forestland in order to maintain the value of the assets. It also includes additional forest management expenditure required due to expected incidence of forest fires (or other events) due to climate change.

- The resource provisions line refers to possible exposure from additional costs due to climate change such as the additional cost of transferring water from off-site. However, given the expected increase in precipitation in Sweden, this is not considered to be material in this case.

- The retained earnings line is the bridge to the income statement (as in financial accounting) and could be initiated from the start of an investor’s holding period.

Next steps:

This case study was developed as part of a collaborative report with the brokerage firm Kepler Chevreux “Bigger than Carbon: A systemic View” (link). Since the publication of the report, we’ve shared the case study with investors and corporations across Europe. The feedback so far indicates that Natural Capital Statements would make the following possible:

- Communication of findings easier – since the statements are designed following the same structure and principles as financial statements.

- Engagement between the investors and companies more effective – linking the quantitative / narrative analysis from ESG and monetary analysis from financial data.

- Although the estimates about the value of natural capital are approximations, they help investors begin the discussion on a lot of issues that are usually only reported on qualitatively or as a case study.

- More thorough due diligence for investors that conduct deep-dives into individual holdings.

- Better investment monitoring and assessment of holdings.

The principles of Natural Capital Statements can also be applied to social capital analysis, although this would require more context-specific information to develop an impact pathway (/theory of change).

The Natural Capital Statements could also be integrated into analysis for fixed income or alternatives to better monitor and communicate the impacts of (for example) green bonds or direct investment in forestland.