The company in brief:

Natura is the leading multinational Brazilian company operating in the cosmetics, personal care and beauty industries. With its headquarters in São Paulo, the company employs around 6500 staff in eight countries. The company has a Sustainability Vision which assumes the commitment of integrating environmental and social impacts into Natura’s economic results by 2020.

Why a natural capital assessment?

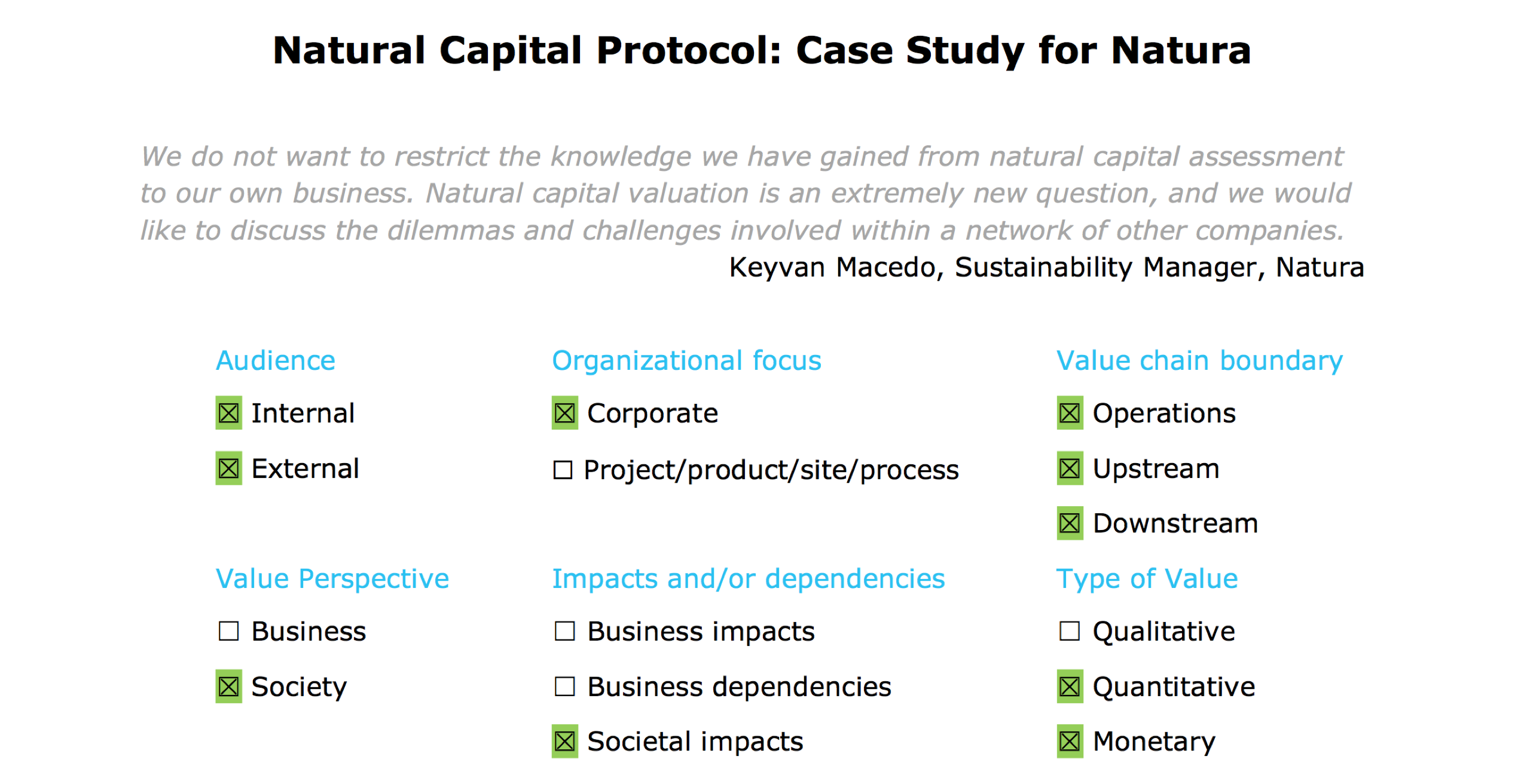

Aware of the pressing need for action to reduce ecosystem impacts, Natura began looking for ways to account for natural capital throughout its business value chains. In 2014, Natura undertook its first natural capital assessment to calculate the monetary value of its impacts and their societal consequences. The review included GHG emissions and air pollution, water pollution and use, waste and land use, and resulted in an Environmental Profit and Loss account, or EP&L.

Natura believed that quantifying its impacts would make it easier to reduce negative impacts and leverage positive ones (for example, by innovating in use of materials and the production processes). Natura also appreciated that undertaking a natural capital assessment and disclosing information externally would provide a degree of transparency which is important to its stakeholders.

How was the natural capital assessment used?

Through its assessment, Natura hoped to inform whether the choices it was making in terms of sustainable ingredients and production systems were superior to business-as-usual. This required, firstly, establishing clear environmental baselines, and selecting appropriate methodologies.

What were the outcomes of the assessment?

Natural capital assessment results showed that GHG emissions represent one of the greatest impacts among all those measured along the value chain. As Natura is a Carbon Neutral company it has implemented measures to reduce GHG emissions, with ambitions to achieve a 33% reduction along the value chain by 2020 relative to 2012. Calculating the monetary value of these measures between 2006 and 2013, the GHG impact avoided was found to be equivalent to around R$101MM.

The results of Natura’s assessment also showed that water consumption generates a significant impact on society, particularly in the use stage, due to a major part of its portfolio comprising hygiene and bathing products. Here Natura sees communication and education as paramount, to encourage more efficient use of resources, particularly among the end-users of its products.

By undertaking an natural capital assessment with a focus on its value chains, Natura knowingly increased the complexity of data collection and methodology adjustments, and hence resources it would need to complete an assessment. A positive outcome of this choice however, was that the company arrived at a detailed set of information and data useful for supporting decision making.

With support from the consultancy PwC, Natura was the first company in Latin America to conduct an in-depth EP&L assessment of its business. The company believes that this experience will drive learning that will enable it to reexamine its innovation, distribution and production processes. This in turn will ensure greater quality in strategic decision making at Natura, helping the company to achieve its 2050 Sustainability Vision.

Next steps

Since natural capital assessments are an emerging field, Natura realizes that a number of metrics still need to be improved or adapted to different contexts. This is the case, for example, in accounting for the generation of waste which frequently ends up not being properly disposed, polluting rivers and oceans. Natura continue to work on measuring these impacts in an attempt to ensure that its methods reflect all of its operations, and remain current.

Natura sees a requirement for methodological innovations in the area of assessment around biodiversity impacts. This includes ways of accounting for the stock of natural capital in a given location and services such as food security, pollination, soil carbon, animal habitat, water production in forestry conservation and biological control.

A key next step for Natura is the valuation of impacts and benefits generated by the business for community development including employment and social enterprise, using SP&L (Social Profit and Loss) assessment.

Natura intends to share its learnings with other Brazilian companies. Its goal is to mobilize a network of entrepreneurs to discuss findings and to drive further improvements in the metrics for specific local contexts. To other companies, it advocates seeking advice from other companies that have applied the Protocol, and reading the Protocol guidance extensively before starting out. Natura also recommend the involvement of a cross functional team including supply chain, finance and investor relations, and ensuring that location-specific aspects brought about by global working are accounted for.