Guidance launched today by the Capitals Coalition and Cambridge Conservation Initiative will enable businesses and financial institutions to put the value of biodiversity at the heart of decision making.

London, United Kingdom, September 29 2020: The importance of biodiversity is increasingly recognised for its role in building resilience against climate change, in supporting communities and livelihoods, and for its essential role in underpinning our broader society and the global economy. However, a lack of consistent tools and frameworks to effectively integrate this value into internal corporate decision making has hampered efforts to date and contributes to the rapidly accelerating destruction of biodiversity and mounting risk and exposure for businesses and financial institutions.

Recognising the value of impacts and dependencies on biodiversity provides a clear business case for the protection of and investment in the health and resilience of biodiversity around the world, leading to cascading benefits for nature, people and the economy.

The Guidance will help businesses and financial institutions ensure that they better capture the value of biodiversity in their decision making. This will enable holistically informed, nature-positive decisions that safeguard the benefits that biodiversity provides to us all.

This Biodiversity Guidance is a companion to the Natural Capital Protocol, a decision-making framework that enables organisations to identify, measure and value their impacts and dependencies on natural capital.

Global biodiversity is in rapid decline. The recent Living Planet Report found that the population sizes of mammals, birds, fish, amphibians, and reptiles have seen an average drop of 68% since 1970. The Global Biodiversity Outlook 5 found that only 6 of world’s 20 global biodiversity goals will “partially achieved” by the 2020 deadline if existing national commitments are met, and the IPBES Global Assessment estimates that one million species are at risk of extinction.

This newly launched Guidance will empower businesses, financial institutions, policy makers and other organizations to affect positive change by conducting biodiversity-inclusive natural capital assessments2 to inform their decision making using the step-by-step approach of the internationally standardised Natural Capital Protocol.

Global and regional frameworks for biodiversity such as the post-2020 global biodiversity framework and the EU Biodiversity Strategy for 2030 are moving towards frameworks and strategies that promote business decisions that value nature.

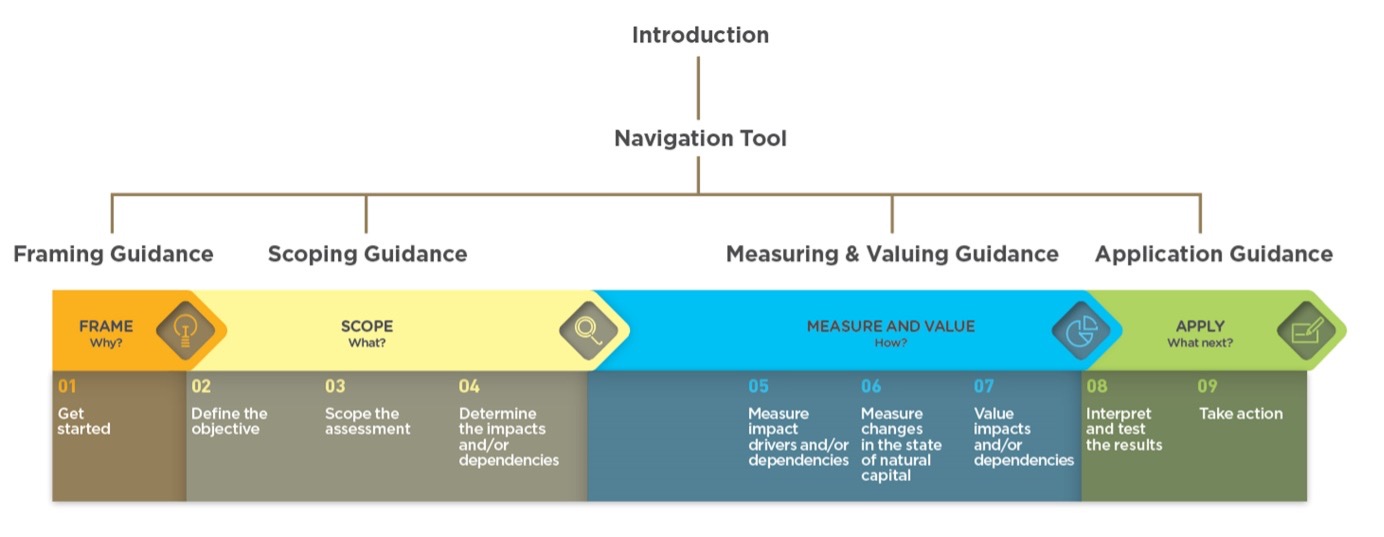

There are four stages to the Biodiversity Guidance – Why? What? How? and What Next? A Biodiversity Guidance Navigation Tool and two introductory primers will be launched later this year to guide users through a biodiversity-inclusive natural capital assessment, suggesting several tools and methodologies to successfully complete the process.

The guidance has been piloted by leading businesses and financial institutions who dedicated significant resources to ensure that their peers will understand and benefit from this work.

The need to halt and reverse biodiversity loss – for our own well-being and for the health of the planet – has never been greater. This Guidance will enable organisations to bring the value of biodiversity to the forefront, and help them to accelerate their sustainable journey.

[ENDS]

Mark Gough, CEO of the Capitals Coalition said: The success of organizations around the world is dependent on the value they receive from the capitals; natural, human, social and produced. The value provided by biodiversity is a key part of this. Providing organizations with the tools needed to understand this value and to operationalise it in business decisions will provide a more holistic understanding of the system in which organizations operate, leading to integrated decision making with broad benefits across the capitals.

Jonny Hughes, WCMC Chief Executive Officer at the UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC), said: “The next ten years is the only window we have for tackling the global crisis facing nature. Every part of society will need to be involved in reversing biodiversity loss, but particularly the private sector. This Biodiversity Guidance will be crucial to helping businesses and financial institutions urgently measure and understand their impacts and dependencies on nature and become nature-positive.”

Robert Alexandre-Poujade, analyst at BNP Paribas Asset Management, a piloting organization said: “The Biodiversity Guidance is the one-stop shop for biodiversity applied to finance. It uses the best available science and provides a clear framework for financial institutions to use in developing their biodiversity strategies, and ultimately reduce their impacts and manage their dependencies on nature.”

Humberto Delgado Rosa, Director at the Directorate-General for Environment at the European Commission, said: “It is essential for corporate decision makers to gain comprehensive insights into both the impacts and the dependencies of their products and processes on natural capital and biodiversity throughout the value chain. This guidance will provide a very useful contribution to the implementation of the new EU Biodiversity Strategy 2030, which aims to better integrate biodiversity into business’ decision making”.

NOTES TO EDITORS

Media Contact: Joseph Harris-Confino (Head of Communications, Capitals Coalition)

E: joseph.confino@capitalscoalition.org

This Guidance is part of the Integrating Biodiversity into Natural Capital Assessments project run in collaboration between the Cambridge Conservation Initiative and the Capitals Coalition. The Cambridge Conservation Initiative is the focal point of research and advice on biodiversity issues for the Coalition.

Developing this guidance has been a collaborative effort. UNEP-WCMC has led the final stages to formalise this guidance and the Cambridge Conservation Initiative partners that have contributed to this project include: BirdLife International, Fauna & Flora International (FFI), Royal Society of the Protection of Birds (RSPB), United Nations Environment Programme-World Conservation Monitoring Centre (UNEP-WCMC), University of Cambridge Conservation Research Institute (UCCRI) and the Cambridge Institute for Sustainability Leadership (CISL).

This project received funding from the European Commission DG Environment under the LIFE Programme. This project also received funding from BNP Paribas Asset Management, the German Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety, Kering and Repsol.

The Biodiversity Guidance is written for businesses and financial institutions. It does not replace the Natural Capital Protocol, but is meant to be used alongside it. The Protocol can be found at www.naturalcapitalcoalition.org/protocol.

For financial institutions it will also be useful to have a copy of the Connecting Finance and Natural Capital Supplement which can be found at www.naturalcapitalcoalition.org/finance.

The Natural Capital Protocol (the Protocol) is an international standardized decision making framework that enables organizations to identify, measure and value their impacts and dependencies on natural capital in order to inform organizational decisions. The Protocol Framework covers four Stages, “Why” (Frame), “What” (Scope), “How” (Measure and Value), and “What Next” (Apply). These Stages contain specific questions to be answered when integrating natural capital concepts into organizational processes.

More information and the Biodiversity Guidance are available here.